chances of retroactive capital gains tax

15 to do so. Reduced the maximum capital gains rate from 28 percent to 20 percent.

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Miller Chevalier Chartered.

. The proposed capital gains rate hike may be retroactive to the date of. The bank said razor-thin majorities in the House and Senate would make a big. Retroactively for income over 1M capital gain tax is now 434.

However qualified small business stock the darling of the. Castro Marc J. Myers adds he thinks the likelihood of retroactive taxes is greater than 50 percent but notes the Biden administration may settle on a lower rate for capital gains like 30 percent.

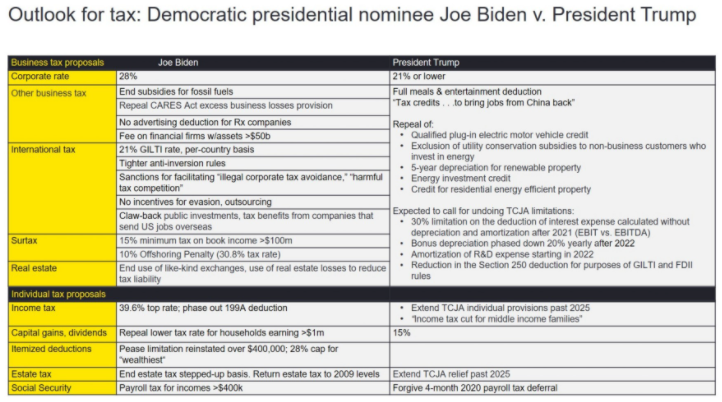

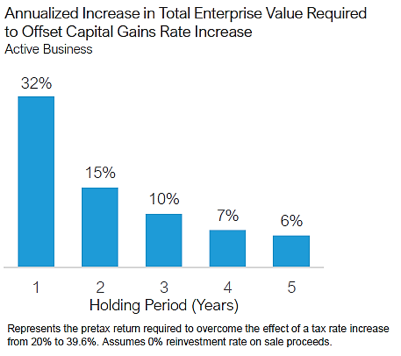

The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million with those high net families paying a higher tax rate. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden.

The plan to make its tax increases retroactive makes no sense if the objective is as the Biden administration claims to raise revenue rather than to punish the successful. Evercore Co-Chief Executive Officer Ralph Schlosstein discusses the Biden administrations plan to raise taxes on wealthy Americans and corporations shareholder. Working with an investment advisor to regularly rebalance asset allocation by utilizing a tax-managed strategy that efficiently manages realized gains and losses.

Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more. You can get up to 10M tax free that way a zero tax. By Jorge E.

Gerson and Loren C. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge. Oct26 -- Adam Sender founder of Sender Company Partners SCP discusses how he is positioning ahead of the 2020 presidential election.

He speaks on Bl. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates. If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase.

Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate. Signed 5 August 1997. 7 rows Introduced 24 June 1997.

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. Effective for taxable years ending after 6 May 1997 ie for. They have until Oct.

The US Treasury Department on Friday confirmed that the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20 to 396 for the sliver of.

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

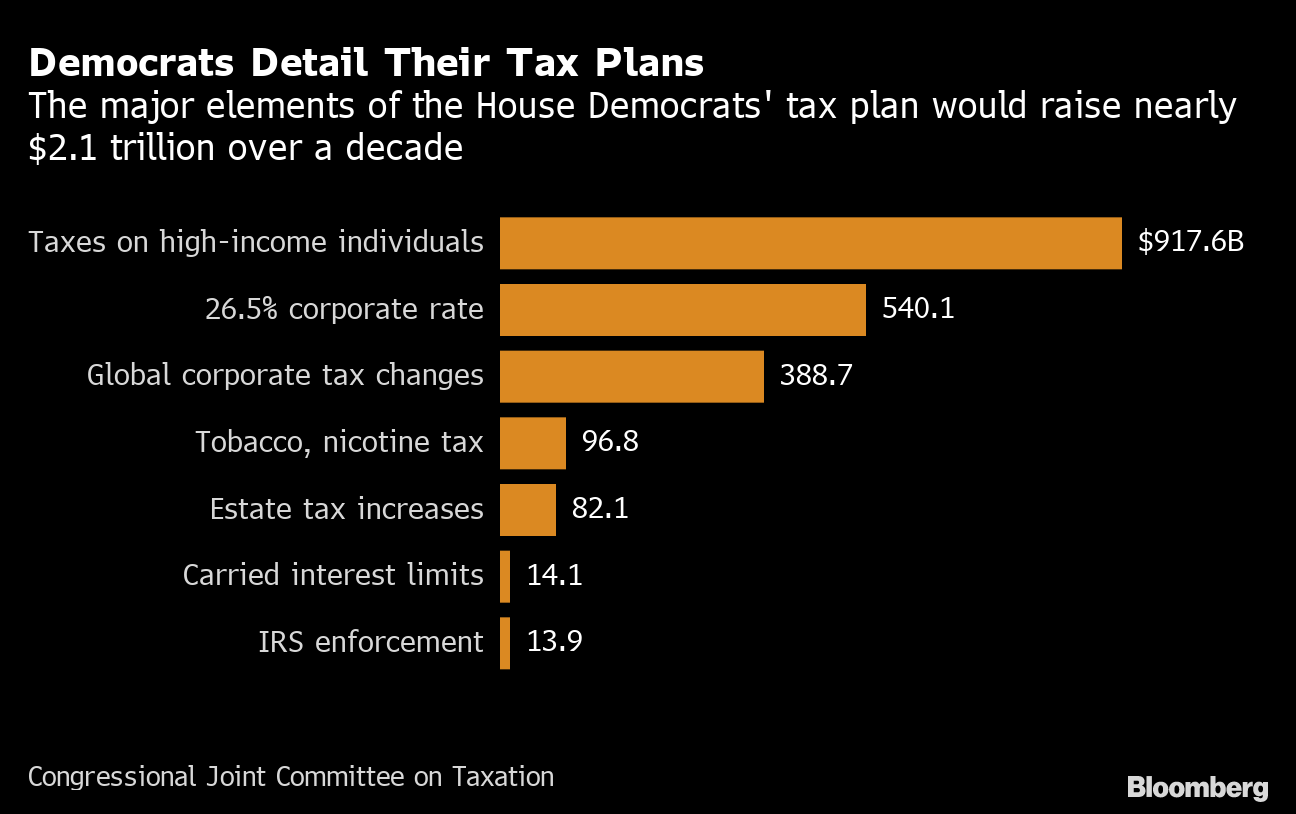

Higher Taxes May Be On The Way For Wealthy Americans After House Vote

Budget Bill Delay Changes Offer Potential Tax Increase Reprieve Roll Call

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

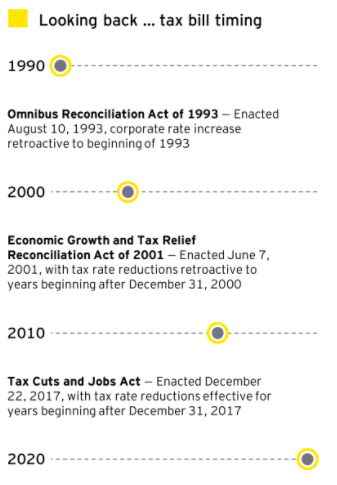

History And Retroactive Capital Gains Rate Changes

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio

Post 2020 Tax Policy Possibilities Lexology

75 Of Stock Owners Won T Pay Biden S Proposed Capital Gains Tax Hike

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Mechanics Of The 0 Long Term Capital Gains Rate

Long Term Capital Gains Tax Rates In 2017 The Motley Fool

Will You Be Paying Higher Taxes On Your Capital Gains Elderado Financial

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

Higher Taxes May Be On The Way For Wealthy Americans After House Vote

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors